A global quantitative R&D powerhouse headquartered in Athens, uniting scientists, engineers and researchers to push the boundaries of algorithmic trading.

Our Story

Mathisys Technologies Hellas started its journey in 2014, when Dr. Nicholas Kondakis founded NSGQ Hellas with the vision of applying scientific rigor to the international financial markets.

In 2018, the firm evolved into Mathisys Technologies Hellas, preparing to join the international Mathisys group, comprising the quantitative hedge fund Mathisys Capital LLP and its advisor, Mathisys Advisors LLC.

Today, we operate research hubs in Athens, New York, New Delhi, and Shanghai, united by a single mission: to build intelligent algorithms that continuously learn, adapt, and evolve, redefining the future of algorithmic trading.

Our Mission

Our mission is to advance the science of algorithmic trading by pushing the boundaries of quantitative research and technological innovation.

We are committed to designing, developing, and deploying intelligent trading models that continuously evolve and adapt to the ever-changing dynamics of global financial markets.

By fostering a culture of collaboration, transparency, and intellectual meritocracy, we ensure that every idea is rigorously tested, every insight is valued, and every discovery contributes to long-term value creation.

Through this blend of innovation, research excellence, and teamwork, we aim not only to deliver superior investment outcomes but also to redefine the future of algorithmic trading.

Our Vision

Our vision is to shape a future where intelligent algorithms serve as trusted partners in unlocking deeper market understanding and creating new avenues of opportunity.

We aspire to pioneer a world where advanced quantitative methods and machine learning seamlessly integrate with human ingenuity, enabling smarter decision-making, greater transparency, and more efficient markets.

By pushing the limits of technology and cultivating a spirit of curiosity and continuous learning, we aim to establish a lasting legacy, where algorithmic innovation not only delivers sustainable financial value but also contributes to the evolution of global finance as a discipline built on fairness, adaptability, and discovery.

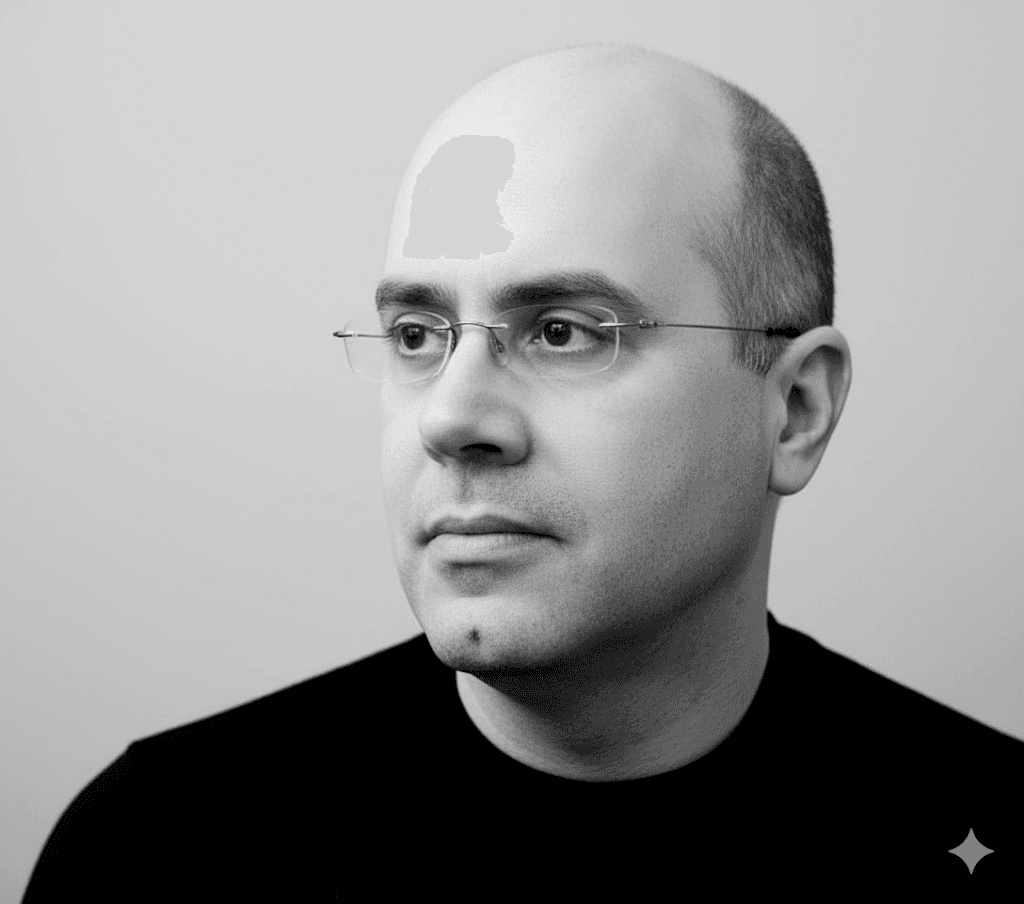

Dr. Nicholas Kondakis is the Chief Executive Officer of Mathisys Technologies Hellas. With over 30 years of experience across global equity, bond, foreign exchange, and commodity markets, he has designed and managed strategies spanning ultra-low latency, high-frequency, and medium-term horizons. Throughout his career, he has led multi-disciplinary research and development teams in executive roles at quantitative hedge funds, advancing the integration of scientific rigor into modern financial systems.

His professional interests focus on the design and implementation of algorithmic trading strategies grounded in statistical modeling, artificial intelligence, and data science methodologies. He is particularly engaged in developing predictive models for financial markets using large-scale data analysis and insights from the natural sciences.

Dr. Kondakis holds a Ph.D. and M.A. in Experimental High Energy Physics from Columbia University in New York, and a B.S. in Physics from the University of Athens, Greece. He has held research appointments at Princeton University, Columbia University, and SUNY Stony Brook, contributing to experiments at Brookhaven National Laboratory, Fermilab, and CERN. Since 2005, he has served as an Invited Professor and Scientific Consultant at the University of the Aegean, Greece, where he teaches a postgraduate course on the Dynamics of Financial Markets.

Focus on algorithmic innovation and quantitative research • Located in Athens, Greece • Trading financial markets globally

Created by

designco